- #Free budget software monthly for free#

- #Free budget software monthly upgrade#

- #Free budget software monthly download#

- #Free budget software monthly free#

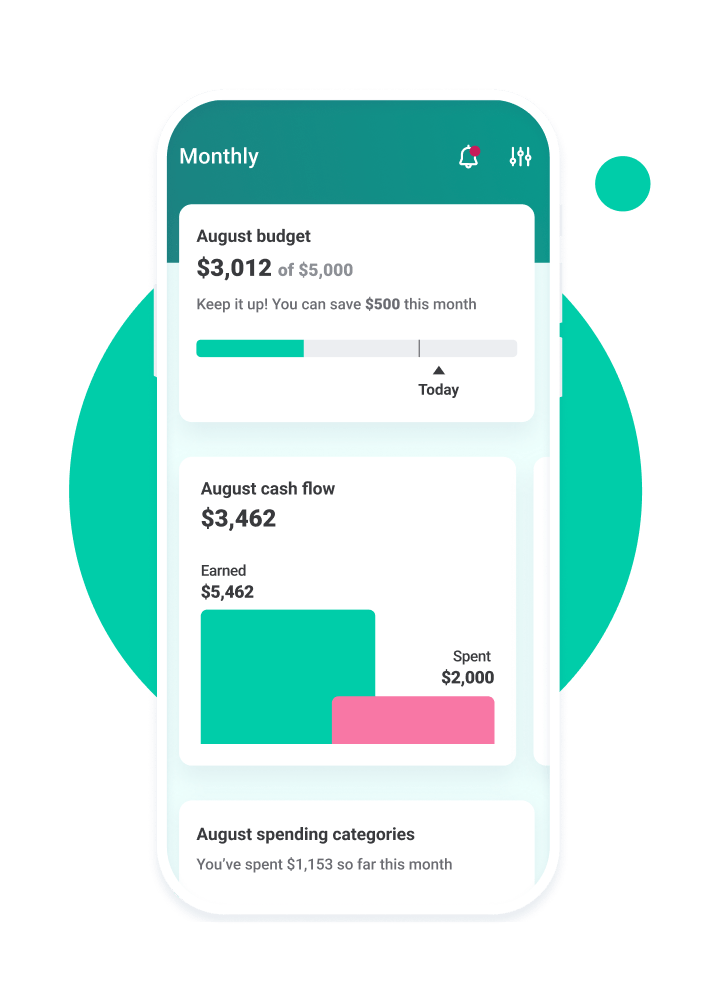

Similar to Mint, PocketGuard syncs up with your various financial accounts.

#Free budget software monthly free#

PocketGuard is another free budget app that’s designed for people who like simplicity when it comes to managing their money. Who It’s Good For: Mint can work well for beginning budgeters or anyone who wants to be able to see exactly where his money goes at an easy glance.

#Free budget software monthly for free#

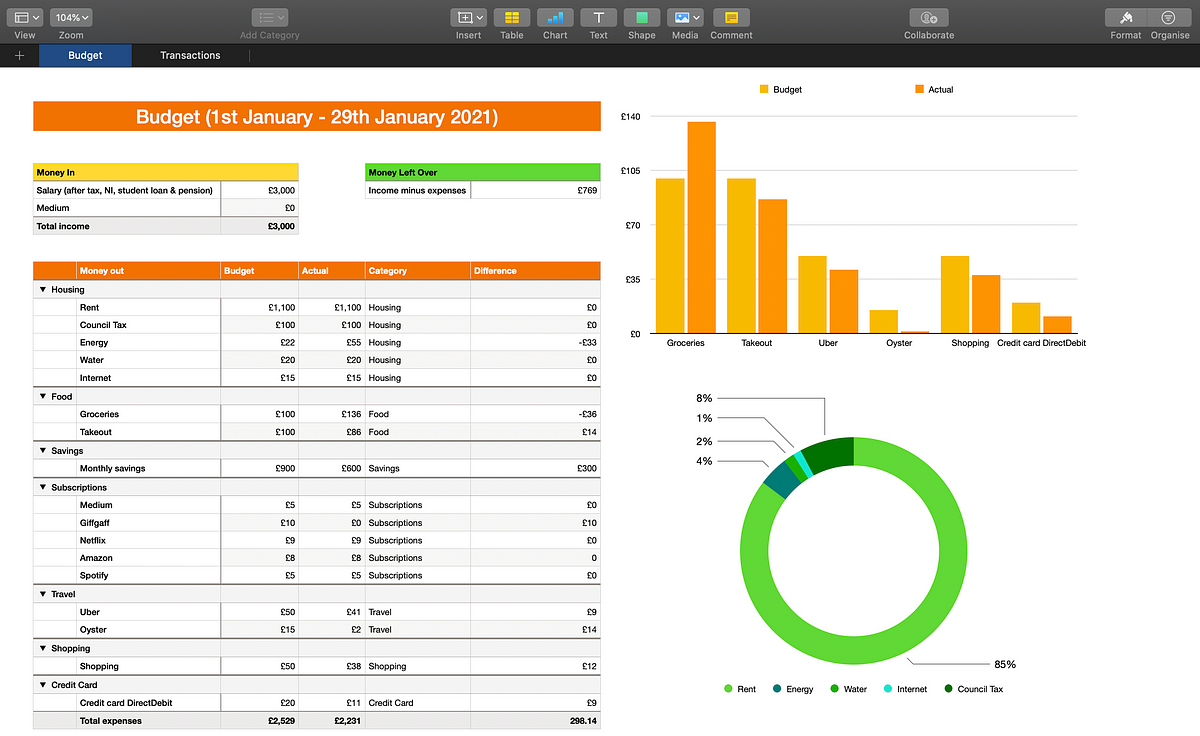

Mint also allows you to check your credit score for free and get free credit monitoring. So if you want your money to go toward paying off debt, building your emergency fund, investing, saving up for a house. As you’ve learned, budgeting is how you tell your money where to go. And listen, whether you’re on Baby Step 1 or 7, you need a budget. Crush Dave’s Baby Steps even faster.ĮveryDollar is the only budgeting tool created with the Baby Steps in mind.

If you’re married, you can both sign in to the same account so you can budget together, even when you’re apart. We already mentioned how you can use your EveryDollar budget on the app or desktop (or both). In EveryDollar, you can set up funds in minutes and watch your progress any time, any day. Sinking funds are a great way to save up for expenses that only come around once or twice a year (like car insurance or Sir Barksalot’s yearly checkup) and big purchases (like a new set of tires, a TV, or a trip to the beach). The visual reminder will show up under that budget line every time you open EveryDollar, so you won’t forget when to pay-or when that auto draft will come out. Just tap on a bill in your budget and add a due date in seconds. Say goodbye to the stress of remembering when bills are due. You can budget where you want with EveryDollar. Or do it on your desktop if you prefer-it’s super easy there too. If you see you overspent on one budget line, adjust another line then and there.

#Free budget software monthly download#

When you download the EveryDollar app, you can see your budget in a matter of a couple quick taps! Check in often so you can catch an overspending problem before it ever happens. Check in throughout the month.Ĭhecking in on your budget throughout the month is a heck of a lot easier when you can do it on your phone. Tracking is how you keep up with the plan. All you’ll have to do is drag and drop each transaction to the right budget line!Įither way, EveryDollar makes it easy, because tracking is a must.

#Free budget software monthly upgrade#

If you upgrade to Ramsey+, it’s even easier-you'll get the premium version of EveryDollar so you can connect your budget to your bank and let those transactions stream in automatically. Or on your couch right after you pay that bill online. You can even do it in your car before you ever leave the store parking lot.

On EveryDollar, you can add an expense and slide it over to the correct budget line in no time. The key to keeping your spending in check? Track. You’ll know you’ve budgeted to zero when you see a big green check mark and the words “It’s an EveryDollar budget” at the top of your screen. This is called zero-based budgeting, and it’s the best way to take control of every single dollar you make.

But we’ve narrowed it down to the top eight: 1. This means EveryDollar goes where you go, which makes it super easy to budget from anywhere. You can use it on your desktop or download the app to your phone. What Is the EveryDollar Budgeting App?ĮveryDollar is Dave Ramsey’s practical, mobile, free (yes, really) budgeting tool. What’s so great about EveryDollar? Glad you asked. That sounds awesome, right? Let’s get budgeting right now!īut with so many ways to budget out there, how do you pick a method you’ll actually use? Insert EveryDollar. You’re telling it where to go so you’re not left wondering where it went. When you budget every month, you’re giving your money purpose. A plan for what’s coming in and what’s going out. A budget isn’t a straitjacket on your spending.

0 kommentar(er)

0 kommentar(er)